Part Nine. Micro-deflation, health, technology, stocks, crime and Current Services Baseline Budgeting?

This is Part Nine of a series showing how inflation, deflation, barter, tariffs, taxes, postage, war, counterfeiting, history, economics, free trade, famine, dearth, climate, auctions, precious metals, religion, and education are combined into one great whole.

Part Nine. Why study micro-deflation, health, technology, stocks, crime and Current Services Baseline Budgeting?

26) Health micro-inflation. Deflation means purchasing power of cash increases or expands going forward. Today my $5 will buy a paperback book , tomorrow 2nd day $5 will buy 2 books, 3rd day $5 will buy 3 books. The book values or prices are deflating. Most people, seeing such would hold the $5 for 3 days to buy 3 books. What is the Result? Business activity slows while people wait for better and better deals. Similar to putting off buying spree until after the Christmas sales and scoop up excess inventory at a fraction of the price a day or week before. This is effective if you can wait, for the change of model year for cars, and the price of last year’s model drops by thousands of dollars.

But waiting is not an effective option, deflation or no deflation, if you can’t wait. Such as the starving needing to buy food. Or the refugees buying transportation for fleeing an oncoming hurricane or typhoon. Or refugees fleeing a war zone ahead of an advancing army.  Or such as needing an antibiotic, such as for penicillin for infection. That is the plot of the movie . ‘Made for each other’ with Jimmy Stewart and Carol Lombard. A plot emergency describes an inflation price for units of penicillin to save baby’s life. The price of a house, in cash, a substantial house in a prime neighborhood, equivalent to twice the price of the airplane. If the parents didn’t need the medicine, they could wait for the mass manufacture and a much much lower price, a deflated price. A pandemic could drive medicine prices beyond the skies, with no limit.

Or such as needing an antibiotic, such as for penicillin for infection. That is the plot of the movie . ‘Made for each other’ with Jimmy Stewart and Carol Lombard. A plot emergency describes an inflation price for units of penicillin to save baby’s life. The price of a house, in cash, a substantial house in a prime neighborhood, equivalent to twice the price of the airplane. If the parents didn’t need the medicine, they could wait for the mass manufacture and a much much lower price, a deflated price. A pandemic could drive medicine prices beyond the skies, with no limit.

27) Technology micro-deflation. Back to the examples of deflation. Assume today, my $5 will buy a Big Mac, and by tomorrow my $5 will buy 2 Big Macs, and by the 3rd day, my $5 will buy 3 big MACS. This is deflation of the price of Big Macs. Can I go without eating for 3 days to get my 3 big MACS for $5? Most cannot go without eating for 3 days, voluntarily. So the general concept is deflation is bad for business. Total deflation means a barter economy.

We have seen this in technology. In 1950 a ball point pen cost $50 (about $700 in 2018 purchasing power), by 2018, the ball point pens are handed out for free as advertising swag. In 1975, the pocket calculator (Hewlett Packer) was about $700 (about $2,500 in 2018 purchasing power), and today they are $10 to $40 apiece. In 1954, a television set (black and white monochrome at $500) was a fourth the price of a car ($2000), and now the TV (with color) is the price of a tire for the car. Mass production, assembly line, innovation, efficiencies, reduce prices of many things.

Barter economy runs at 1/10th or 1/1000th slower than the speed of the medium of exchange economy (currency, specie, plants, tobacco, cowry shells, whatever is acceptable – IOUs).

28) Stock market inflation and single stock micro-inflation and micro-deflation. The idea of the capital economy is that by marketing stock, you can establish a price, the auction price. This brought many investors together for mutual benefit. The capital economy started in the 16th century, and the stock market was well established in London by the mid 18th century. Later in New York after Independence we had the curb exchange. First, capital went with sailing ships and trade, then insurance, then companies. The German citizens investing in the stock market before the October 1923 hyper inflation saw wealth flow into their stock investments, out of and from the rest of the country, which was not in the stock market. [i]

Likewise, in the 21st century, internet and online industry has pulled wealth from other industries. For every ad on Facebook, ad revenue has drained away from a magazine, newspaper or TV or radio station. For every PC, MacBook Air, or smart phone sold by Apple, wealth has left the US Postal Service or book publishers. Apple’s market value exceeds $900 billion, Google’s parent (Alphabet) market capitalization is $800 billion, Amazon is $700 billion with a price 316 times earnings ratio. What does a billionaire do? Diversify. Amazon’s multi billionaire founder ($80 B as of 2017) has purchased the Washington Post (about $250 million), 400,000 acres of land in Montana or Texas (Landreport.com). The founder of TBS, CNN, owns hundreds of thousands of acres in Montana. Don’t leave it all in the capital subject to the auction market.

29) Post war hyper inflation. After the World War Two, Hungary, occupied by the Soviets, had inflation rates in 1945 to 1946, where prices doubled every 15 hours, and the Hungarian government announced the latest inflation rate by radio every morning, so workers could negotiate a new pay scale every day. The Hungarians issued a legal tender note of 100 quintillion (10 to the 20th power). When the currency was withdrawn, the total value of all cash was estimated at one mill (a tenth of a cent).[ii][iii] The currency inflating to everything became worth nothing, deflated to barter.  Postage was Thirty Two cents (32 cents) after the election when the Republicans won a majority in the House of Representatives for the first time in 46 years (1995), Panama canal Opens 1914. This stamp plus 17 cents more to mail a letter in 2018.

Postage was Thirty Two cents (32 cents) after the election when the Republicans won a majority in the House of Representatives for the first time in 46 years (1995), Panama canal Opens 1914. This stamp plus 17 cents more to mail a letter in 2018.

30) Crime micro-deflation. Deflation results from taking cash out of circulation, and this happens in crime. Crime does not add value to an economy, and the more crime the more likely the barter economy results. Crime has many forms, bunko (swindles stealing money under false pretenses), grand theft (stealing property on cash), fraud (stealing by deception), gambling (something for nothing), grand theft auto (stealing cars and trucks), armed robbery (using weapons to threaten the victim), drug addiction (illegal expensive drug use also leads to more crime), extortion (threats to steal money by avoiding destruction of property or injury), injury and murder, insurance fraud (encourages arson and other injuries), reckless damage, looting (raiding mercantile businesses in distressful time of disaster or riot), identity theft, credit card fraud, Ponzie scheme, burglary, lie, cheat, steal, forgery, counterfeit, black mail, prostitution, kidnapping, hostages, ransom. Gambling removes money from circulation. Lotteries have become popular tax raisers, for governments. Lotteries absorb taxes, and remove money from circulation, often moving the proceeds that are left out of the area, forcing a micro-deflation. 49 of 50 states have some form of gambling, which also adds little or no value added to the economies of the gamblers. Often gamblers justify gambling as a form of entertainment. If the gambling as entertainment removes services or products from the auction economy or consumption, it will result in both removing money and services, lowering both into a spiral into a barter economy.  1984 20 cent Take a bite out of crime, McGruff the Crime Dog. Crime prevention month.

1984 20 cent Take a bite out of crime, McGruff the Crime Dog. Crime prevention month.

Crime and gambling can be quantified in the many billions of dollars. Riots, arson and looting for blocks or square miles will ruin the business districts, as happened in Compton California in the 1960s, Baltimore Maryland in the 2000s, St Louis in the 2000s, or other neighborhoods. The rioting is just as good as a war zone to destroy confidence. Guard or security forces costs increase the cost of doing business, without increasing added value. Hence products and service costs increase to cover the additional protection which may not work anyway.

Terrorism hopes for deflation of the target economy into a barter economy. After the 911[iv] attacks into the World Trade Center in New York City, and Pentagon, travel world wide decreased. One area of declining tourism was Hawaii, which saw a drop of 90 percent at it tourist attraction, which by 2018 has since recovered to about half of the pre 911 business. Reduced business in tourism means reduced attendance, eventual reduction in prices to compete, and further loss of activity.

31) Government savings accounts and bonds have deflationary pressure. During war time, such as World War two, the government offered savings plans and war bonds. By encouraging savings, the government pulled out cash that would have chased scarce services and products, deferring the use of the money for years. This is a One Dollar 1941 U.S. Postal Savings certificate of Deposit which is not transferable. The government gets use of the money, like taxes, and can consume it anyplace else in the country or world. When this comes due, the owner may continue to save the money (deflation) or consume and spend the money (inflation).

By encouraging savings, the government pulled out cash that would have chased scarce services and products, deferring the use of the money for years. This is a One Dollar 1941 U.S. Postal Savings certificate of Deposit which is not transferable. The government gets use of the money, like taxes, and can consume it anyplace else in the country or world. When this comes due, the owner may continue to save the money (deflation) or consume and spend the money (inflation).

32) Current Services Baseline Budgeting micro-inflation. Every US Congress budget item is guaranteed an eight to ten percent increase over the previous budget. The civil service grades and consequently pay increases are based on longevity and seniority. Every year hundreds of thousands of civil servants receive automatic promotions, whatever the national situation is, good, bad, or ugly. Such is “baseline budgeting,” which began in the 1970s. There is a thing in the federal government called “the Current Services Baseline,” and that is the starting point every year, not zero. The Current Services Baseline requires, mandates, whatever, that every line item in the federal budget be increased by anywhere from three to 10% every year, no matter what is spent on that line item.[v] Since the Federal Budget is about $4 Trillion, a 5% increase is about $200 Billion increase annually. This forces some micro-inflation every year in the economy, which is not distributed around the country. For instance 300,000 or perhaps 30 percent of the civilian service workforce live inside the beltway around Washington D.C. They will get raises every year. The rest are distributed in pockets around the country.

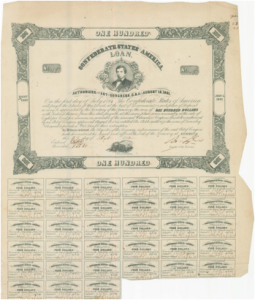

‘’ One Hundred Confederate States of America Loan, Authorized by the Act of Congress C.S.A. of August 19, 1861. On the first day of July 1881, The Confederate States of America will pay to the Bearer of this Bond at the Seat of Government or such place of Deposit as may be appointed by the Secretary of the Treasury, the sum of One Hundred Dollars. * An Act to authorize the issue of Treasury Notes and to provide a War Tax for their redemption.’’ This 27 day of Oct 1862.’’ The 1881 delivery never occurred as the bond deflated to zero.

‘’ One Hundred Confederate States of America Loan, Authorized by the Act of Congress C.S.A. of August 19, 1861. On the first day of July 1881, The Confederate States of America will pay to the Bearer of this Bond at the Seat of Government or such place of Deposit as may be appointed by the Secretary of the Treasury, the sum of One Hundred Dollars. * An Act to authorize the issue of Treasury Notes and to provide a War Tax for their redemption.’’ This 27 day of Oct 1862.’’ The 1881 delivery never occurred as the bond deflated to zero.

[i] “Kipper und Wipper”: Rogue Traders, Rogue Princes, Rogue Bishops and the German Financial Meltdown of 1621-23

https://www.smithsonianmag.com/history/kipper-und-wipper-rogue-traders-rogue-princes-rogue-bishops-and-the-german-financial-meltdown-of-1621-23-167320079/#HHj3u6zqSEO8gcym.99 In the Weimar Republic’s inflation of 1923, the rate hit 325,000,000 percent, and the exchange rate of 9 marks to the American dollar, rose to 4.2 billion marks to the dollar. A German housewife was photographed using the paper to fire the boiler.

[iii] Ibid. “Kipper und Wipper”: Rogue Traders, Rogue Princes, Rogue Bishops and the German Financial Meltdown of 1621-23

[iv] September 11, 2001.

Disclaimer: The author of each article published on this web site owns his or her own words. The opinions, beliefs and viewpoints expressed by the various authors and forum participants on this site do not necessarily reflect the opinions, beliefs and viewpoints of Utah Standard News or official policies of the USN and may actually reflect positions that USN actively opposes. John Choate © No claim in public domain or fair use.

[v]https://www.rushlimbaugh.com/daily/2013/02/26/ baseline_budgeting_why_the_government_doesn_t_run_its_finances_the_way_you_do/

Utah Standard News depends on the support of readers like you.

Good Journalism requires time, expertise, passion and money. We know you appreciate the coverage here. Please help us to continue as an alternative news website by becoming a subscriber or making a donation. To learn more about our subscription options or make a donation, click here.

To Advertise on UtahStandardNews.com, please contact us at: ed@utahstandardnews.com.

Comments - No Responses to “Part Nine. Micro-deflation, health, technology, stocks, crime and Current Services Baseline Budgeting?”

Sure is empty down here...