Part Eight. Micro-deflation, war, fire, corner, green mail, tariffs and dumping?

This is Part Eight of a series showing how inflation, deflation, barter, tariffs, taxes, postage, war, counterfeiting, history, economics, free trade, famine, dearth, climate, auctions, precious metals, religion, and education are combined into one great whole.

Part Eight. Why study micro-deflation, war, fire, corner, green mail, tariffs and dumping?

21) The reverse of inflation would be deflation, to wit – too much products or services chasing too few money, and driving down the price of products and services – and still describing an auction market. This may continue until products will not be exchanged for money. The products are lost, wasted or given away, or destroyed, intentionally or negligently or unintentionally.

Micro-deflation – personal, local or regional

Inflation of products and services often cures itself, over time. Meaning prices stabilize relative to other If some goods have become ‘dear’ meaning more expensive, dollars chasing too few goods, man’s ingenuity will attempt to cash in on the shortage and higher prices by bringing in more goods, the quicker the better. An example might be gold fields for the California forty-niners, when an egg sold for a days wages back East, or a shovel for a weeks wages. See Roughing it by Mark Twain,[i] where a combination of winter, famine, and shortages, priced amount of hay to feed one horse for 6 weeks, or a little more than a ton, to cost the equivalent of 300 steers in Texas, or 8 to 10 years wages.

A similar event, inflation incentivizing movement, occurs in new oil fields, when wages are up, unemployment disappears, and workers flock to the site, such as Seminole Oklahoma in the 1930s, or Long Beach in the 1920s, or Alaska in the 1970s. In the Roman times, silk from China was hauled thousands of miles to the Roman Empire. Sometimes it is salt, valuable in dry desert climes, which was and is walked 400 miles by camel caravans from salt fields in the Sahara desert to Timbuktu, to enter trade along rivers. Such is trade.

If the reverse occurs, with a sudden loss of economy, which I call a micro-deflation, migration and movement is often reversed, if possible. An individual may lose one’s purchasing power, so the person has no money to chase anything, with the result everything is priced out of reach, and the inflation, although unnoticed to a neighbor, leaves the barren one to barter. Examples are found in war, children, or crime.

War micro-deflation from destruction of civilization

When the invading Nazi armies reached the USSR, i.e. Russia, in 1941, the Russians burned barns, fields, hay stacks, and destroyed animals to prevent their use as food for the invaders, because the products could not be hauled away ahead of the invaders in time to prevent capture. It would be near instant deflation. Products worth nothing because they can’t be hauled off and can’t be sold.

Or, when the front of war moves over an area, the armies may consume food to feed the troops. In centuries when armies built bridges, or carriages, or caissons, wooden spokes for wheels, or burned wood to cook, or for heat, whole forests might be leveled. During the American civil war (1861-1865), for defensive measures, the forests surrounding Washington D.C. were clear cut to the ground, for a day’s march in any direction around the city. This allowed the Army observers to see massed troop movements, if any, approaching the city. The trees are gone, the food eaten, no one can plow or cultivate, the area is empty.

Fire micro-deflation from sudden conflagration

A micro-deflation occurs when trying to create fire breaks ahead of a massive fire. One defense, if the fire cannot be contained, is to burn or pull down fuel, wooden houses or trees, ahead of the fire in order to stop the fire, such as occurred in the great fire of London circa 1666, or Rome AD 64. In 2017, the City of Santa Rosa California fire burned a distance 20 miles pushed by a seventy mile per hour wind, and burned 5,600 homes or structures previously worth $2 billion, because there was not time enough to move the homes out of the way of the fire.

The loss from fire is not only the carbonization of wood or melting of metal, it is also the smoke damage to products, away from the fire. Enough smoke damaged goods have been sold and have given arise to the term ‘fire sale,’ meaning goods at a huge discount (deflation) which are outwardly sound, but stink of smoke. The ‘fire sale’ term has expanded to buying companies or anything out of bankruptcy, meaning buying at a bargain or cheap (deflation). Cheap, as a term, came from London’s Cheapside port, which received the first goods on sailing ships arriving from trade trips, with goods to sell or trade, before they were taken by middle men and marked up for whole sale and retail sale. So buying at Cheapside, became buying ‘cheap,’ and then applied to any bargain, anywhere, for anything.

22) Obsolete micro-deflation. To avoid micro-deflation, products which can be stored, might be delayed chasing the little money and avoid passing to the barter end. Usually storage requires space, and to avoid spoilage, perhaps air conditioning – cool or heat, to control humidity (dryness or wetness). But some products have never come back in value because of obsolescence. The products or services have lost their market. For thousands of years, wagons, carts, and buggies were pulled by oxen, horses, mules, and buffalo. Leather whips were used by the drivers, or teamsters, to control the animals. These whips, also called buggy whips or bull whips, popularized by the Indiana Jones movies because Jones – Harrison Ford – carried his whip, were used for horse buggies. When buggies were replaced by cars and trucks, their need was gone.

More examples of obsolete products or services. Pay phone booths, used by Superman to change his clothes, have been closed as pay phones were replaced by portable smart phones. The telephone booths disappeared and were replaced by nothing. Slide rules, using logarithmic distances for multiplications and division, were replaced by hand held calculator. Standard manual typewriters replaced by electric typewriters, replaced by personal computers and lap tops. Sling shots and arrows, as weapons, were replaced by firearms. Walled cities, vulnerable to cannon, have been replaced by coastal defenses. Papyrus scrolls replaced by movable type, and printed and digitized words. Megaphones replaced by loud speakers. Whale oil for light replaced by petroleum. Rubber tires replaced by synthetic rubber from petroleum. Wicker baskets replaced by plastic barrels. Piece labor replaced by assembly lines, which assembly lines were replaced by robotics. Fire wood replaced by coal, then oil, then gas, then electric heating. Silver glass plates for photography were replaced by celluloid film, from cotton, which was replaced in turn, by digitized electronic graphics. Ships with great sail, were replaced by transoceanic passenger liners, and then replaced by jet commercial airliners. Coal generated steam engines replaced by internal combustion engines. Blood sucking treatments replaced by antibiotics. Newspapers and magazines replaced by internet and satellite communications. Telegraph and cable messages replaced by radio. Cable replaced by wi-fi (wireless fidelity). Storage is not always an option. Space costs money. Services of horse plows or machetes, are replaced by tractors or lawn mowers. If you built, repaired, serviced, any of the obsolete products, you had services chasing no money, and obsolete micro-deflation.  Postage was twenty nine cents (29 cents) in the months between Desert Shield and Desert Storm (1991). The Japanese bomb Pearl Harbor December 7 stamp issued for the 50th anniversary of the attack. This stamp plus another 31 cents required to mail a letter in 2018.

Postage was twenty nine cents (29 cents) in the months between Desert Shield and Desert Storm (1991). The Japanese bomb Pearl Harbor December 7 stamp issued for the 50th anniversary of the attack. This stamp plus another 31 cents required to mail a letter in 2018.

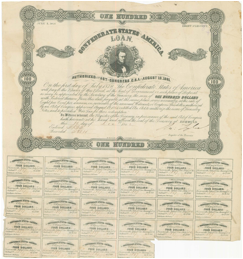

23) Financial micro-deflation. During the US civil war, 1861-1865, the Confederate States of America, to raise money acceptable by vendors, issued, printed, and sold bonds to European investors, including English bankers.

The CSA received pounds sterling or US dollars for the bonds. Promises were made in the bonds, by the CSA to the bankers, but, upon the CSA unconditional surrender, and losing the war, the CSA was powerless to fulfill the bond promises.

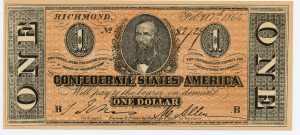

The CSA received pounds sterling or US dollars for the bonds. Promises were made in the bonds, by the CSA to the bankers, but, upon the CSA unconditional surrender, and losing the war, the CSA was powerless to fulfill the bond promises.  The bonds could not be redeemed, nor the promised interest paid. The English Banks placed the bonds in vaults and safes and kept the bonds in the inventory for a century, only releasing the bonds in 1964 to be sold as artifacts to collectors of history, at a value of 1% of face with a purchasing power much lower in 1964 than in 1864. But the storage was relatively cheap, thin documents (sheets of paper), stayed in the vaults with other bonds and currency. Confederate 1864 $100 bill Lucy Pickens[ii], 1864 $5 Richmond[iii], 1864 $1 Clement[iv].

The bonds could not be redeemed, nor the promised interest paid. The English Banks placed the bonds in vaults and safes and kept the bonds in the inventory for a century, only releasing the bonds in 1964 to be sold as artifacts to collectors of history, at a value of 1% of face with a purchasing power much lower in 1964 than in 1864. But the storage was relatively cheap, thin documents (sheets of paper), stayed in the vaults with other bonds and currency. Confederate 1864 $100 bill Lucy Pickens[ii], 1864 $5 Richmond[iii], 1864 $1 Clement[iv].

24) Auction micro-inflation and micro-deflation. are examples of daily, almost instant, inflation due to buying, or deflation due to selling. .Auction markets are all around us, every day, coast to coast, border to border, and world wide. The stock and bond auction markets include the Securities exchanges, to wit – New York Stock exchange, and options exchange, National Association of Securities Dealers (NASD) bonds, commodities exchanges (Chicago and New York for pork bellies or bacon, corn, wheat, cocoa, silver, gold, metals), live stock exchanges (cattle, sheep, pigs on the hoof).

A ‘corner’ on the market describes driving up, or down, the price of stock or commodity, forcing owners on margin to sell or buy to cover losing positions. If the price drops, this is a bear micro-deflation, if the price rises, this is a bull micro-inflation. The commodities markets are the favorite location for these trades, as they operate on very low margins. Sometimes only one percent of the value of the contract controls the entire contract, so if you own a contract and it goes up one percent, you have doubled your money, but if down one percent, you have lost your deposit, such is leverage. The commodity futures markets set a limit move per session, i.e. day, to manage such substantial moves, and limit moves, wherein the days maximum has been reached and further trades are stopped, are about one percent of the trades. About 1969, attempts to corner silver and cocoa were attempted.[v] A decade later, 1979 and 1980, another silver corner was attempted with 3400 tons purchased, estimated at a third of the world’s supply, but the collapse on March 27, 1980, caused panic on other products. A decade later, another silver corner occurred with about 5,000 tons purchased.[vi] Perhaps others, before, or later exist, but this is a corner micro-inflation or micro-deflation.

25) Greenmail micro-deflation or micro-inflation.

Arbitrage in buying in one market at a lower price, and simultaneously selling the same amount and item at a higher price. Market Prices of common stock and warrants, or common stock and convertible debt, if not exactly aligned, will create opportunities for risk free and profitable trades. Markets inefficiencies open up spreads in prices, which present such opportunities with little or no risk, if the market price should collapse. A closed end fund invests in public market stocks, and trades separately from the stocks. The closed end fund arbitrage buys a discounted fund, and shorts the invested stocks, or the arbitrager moves to liquidate the fund. If the fund buys off the arbitrager, the profit is a form of ‘green mail, a portmanteau of ‘black mail’ and green back (describing US currency).[vii] After the 1970s sideways and turbulent stock decade, but it can occur anytime, company stock prices which sold at a discount to the value of underlying assets were open to green mail. The inflation of the 1970s meant some assets had substantial increases but were not adjusted on the book value of assets on the companies. This was especially true for companies investing in hard assets, minerals, land, commercial properties, monopolies. Raiders would identify these opportunities and move on the company.[viii]

25) Seasonal micro-deflation. Lesser auction markets include the multiple listing service for real estate, with prices based on comparative market analysis – where land property or improvements are compared by size – square footage – bed rooms, bath rooms, quality of construction, and sales (a sale must include a purchase). For residential real estate, there exists the buyers’ market, when seasonal prices are depressed or lower, such as winter, when days to shop for property are short, and buyers reluctant to get out in the cold. A seller’s market means seasonal prices are strong, day length is longer for buyers to review homes, and buyers are plentiful competing with each other- to wit spring, summer and fall.

Wholesale and retail auction markets form around offering products and services to the public, by advertising and mass communication. If there is an excess of product or service, more than the market can absorb, the product owner offers incentives to sell. Such incentives are called discounts, coupons, 2 for 1, credit, and are offered to move the products out, make the sale in an auction market. As the discounts increase, such as post Christmas sales wherein discounts of half to 90 percent are quoted, a micro-deflation pops into existence on the value of post Christmas products.

25) Dumping Micro-deflation.

Driving down price on products is an international form of trade war, called ‘dumping’. Dumping is selling products, at a price, below cost of manufacture, or below price sold in the dumpers local market (think nation) in order to drive a competitor out of the market, and even better drive them out of business all together. The barrier to entry interplays with dumping. The barrier to entry is the cost or time required to become marketable. A port requires extensive preparation, to receive and discharge shipping and goods. A medical, legal or engineering education, takes a decade of training after high school in order to prepare to service clients. Preparations for war take years or decades before conflict begins.

The higher the barrier of entry, bringing a product or service to market, the more effective dumping can become. The steel industry is an example of a high barrier to entry. A competitive steel plant requires a billion dollars worth of foundry and furnaces, plus thousands of trained workers. As setting up a billion dollar steel plant, costs so much, the dumping of steel in a competing nation, and driving out of business competitors, becomes so much the better. So when a competitor dissolves the teams of workers, and sells off the improvements, the delay of the enemy country coming back into business is years, decades, generations, or never.

Dumping is outlawed in all nations, but it is slowly and seldom enforced. Those who profit from receiving the dumped and cheaper product, at a price as much as 2/3rds under exporter’s nation’s market price, or even free if it kills the competitor faster, call for ‘free’ trade. There are always consumers in the importing target market who are gleeful to receive dumped goods, getting products below market price. Who wouldn’t want that? See the discussion on Geneva Steel, in Salt Lake City, Utah.

Dumping is not competing with more efficient workers, more skilled staff, better patents and inventions. Dumping is selling into the international market at a cost below manufacture or price below market, in the producing country.

Dumping isn’t to be limited to international trade. Dumping can occur in a local community. One TV series’ plot[ix] was on the frontier west among a teamster hauling company delivering from the railroad terminals to the rural settlements. A company wanted to put the haulers out of business, create a monopoly, and raise prices. The first thing was to attempt to hire all teamsters, the second step was to buy up all wagons and teams. When one hauler held out, the third step was to cut (dump) haul prices by half to absorb all business in the one route, subsidized by monopoly profits on other routes, already taken over. That was the conflict for the plot.

Confederate States of America Loan No 1087 Eight per cent. Authorized by the Act of Congress C.S.A. of August 18, 1861. On the first day of July 1878, The Confederate States of America will pay to he Bearer of this Bond at the Seat of Government or such place of Deposit as may be appointed by the Secretary of the Treasury, the sum of One Hundred Dollars with Interest thereon from this date payable at the same place semi-annually, at the rate of eight per cent per annum on surrender of the annexed Warrants or Coupons. This debt is authorized by an Act of Congress approved August 19, 1861 entitled An Act to authorize the issue of Treasury Notes, and to provide a War Tax for their redemption. In Witness hereof, * affixed the seal of the Treasury of Richmond, this 10 day of Dec 1862. One Hundred. ‘’ 1878 never came, the bond deflated to zero.

Confederate States of America Loan No 1087 Eight per cent. Authorized by the Act of Congress C.S.A. of August 18, 1861. On the first day of July 1878, The Confederate States of America will pay to he Bearer of this Bond at the Seat of Government or such place of Deposit as may be appointed by the Secretary of the Treasury, the sum of One Hundred Dollars with Interest thereon from this date payable at the same place semi-annually, at the rate of eight per cent per annum on surrender of the annexed Warrants or Coupons. This debt is authorized by an Act of Congress approved August 19, 1861 entitled An Act to authorize the issue of Treasury Notes, and to provide a War Tax for their redemption. In Witness hereof, * affixed the seal of the Treasury of Richmond, this 10 day of Dec 1862. One Hundred. ‘’ 1878 never came, the bond deflated to zero.

[i] Roughing It. Chapter 25. pg. 188. When greenbacks had gone down to forty cents on the dollar [1864], the prices regularly charged everybody by printing establishments were one dollar and fifty cents per “thousand” and one dollar and fifty cents per “token,” in gold. The “instructions” commanded that the Secretary regard a paper dollar issued by the government as equal to any other dollar issued by the government. Hence the printing of the journals was discontinued. Then the United States sternly rebuked the Secretary for disregarding the “instructions,” and warned him to correct his ways. Wherefore he got some printing done, forwarded the bill to Washington with full exhibits of the high prices of things in the Territory, and called attention to a printed market report wherein it would be observed that even hay was two hundred and fifty dollars a ton. The United States responded by subtracting the printing-bill from the Secretary’s suffering salary—and moreover remarked with dense gravity that he would find nothing in his “instructions” requiring him to purchase hay! * In the days I speak of he never could be made to comprehend why it was that twenty thousand dollars would not go as far in Nevada, where all commodities ranged at an enormous figure, as it would in the other Territories, where exceeding cheapness was the rule.

*** pen-knives, envelopes, pens and writing-paper be furnished the members of the legislature. So the Secretary made the purchase and the distribution. The knives cost three dollars apiece. There was one too many, and the Secretary gave it to the Clerk of the House of Representatives. The United States said the Clerk of the House was not a “member” of the legislature, and took that three dollars out of the Secretary’s salary, as usual. * White men charged three or four dollars a “load” for sawing up stove-wood. The Secretary was sagacious enough to know that the United States would never pay any such price as that; so he got an Indian to saw up a load of office wood at one dollar and a half. He made out the usual voucher, but signed no name to it—* the voucher owing to lack of ability in the necessary direction. The Secretary had to pay that dollar and a half. * The United States was too much accustomed to employing dollar-and-a-half thieves in all manner of official capacities to regard his explanation of the voucher as having any foundation in fact. *

Chapter 24. Just then the livery stable man brought in his bill for six weeks’ keeping—stall-room for the horse, fifteen dollars; hay for the horse, two hundred and fifty! The Genuine Mexican Plug had eaten a ton of the article, and the man said he would have eaten a hundred if he had let him. I will remark here, in all seriousness, that the regular price of hay during that year and a part of the next was really two hundred and fifty dollars a ton. During a part of the previous year it had sold at five hundred a ton, in gold, and during the winter [1859-1860] before that there was such scarcity of the article that in several instances small quantities had brought eight hundred dollars a ton in coin!

1864 Lucy Pickens, wife of Governor of South Carolina $100 CSA obverse 1864 lucy Pickens $100 CSA reverse

1864 $5 CSA054 #54874 Capitol Richmond Virginia ce Memminger

[iv] 1864 $1 #82129ClementClayCSA pink front uncirculated

1864 $1 #82129ClementClayCSA pink front uncirculated

[v] Paul Erdman wrote novels for his corner attempts in The Billion Dollar Sure Thing (1973) for cocoa, and The Silver Bears (1974). Erdman took his Swiss based branch of United California Bank, into cornering silver and cocoa. Neither Silver nor cocoa worked for the corner. The trick was to know how much of the world’s listed commodity supply was needed to corner the market, in the case of silver about 10 percent was not enough, and for cocoa, half of the world’s market was not enough for a corner.

[vi] Warren Buffett’s Berkshire Hathaway (ticker: BRK), which accumulated silver in 1997 and 1998.

https://www.bullionvault.com/gold-news/silver-buffett-hunts-032820146

[vii] A’ portmanteau’ was a large traveling trunk or suitcase for ocean transatlantic passenger shipping which opened into two equal parts, which morphed into a word describing blending or combining sounds and meanings. See Wikipedia for lists.

[viii] http://www.investmentnews.com/article/20141207/REG/312079993/how-carl-icahn-became-a-corporate-raider

Dec 7, 2014 @ 12:01 am By Tobias E. Carlisle. [In]1975, Carl Icahn and * Alfred Kingsley, hashed out a new investment strategy * Arbitrage is the practice of simultaneously buying and selling an asset that trades in two or more markets at different prices. In the classic version, the arbitrageur buys at the lower price and sells at the higher price, and in doing so realizes a riskless profit representing the ordinarily small difference between the two. * a variation {is] known as convertible arbitrage, simultaneously trading a stock and its convertible securities, which, for liquidity or market psychology reasons, were sometimes mispriced relative to the stock. Conglomerates had issued an alphabet soup of common stock, preferred stock, options, warrants, bonds and convertible debt.

INEFFICIENT PRICING

As an options broker, [he would] * capitalize on inefficiencies between, say, the prices of the common stock and the warrants, or the common stock and the convertible debt. The attraction of convertible arbitrage was that it was market-neutral, which meant * not subject to the risk of a steep decline in the market.

{On] to arbitraging closed-end mutual funds and the securities in the underlying portfolio. A closed-end mutual fund has a fixed number of shares or units on issue. Unlike with open-end funds, management cannot issue or buy back new shares or units to meet investor demand. For this reason, a closed-end fund can trade at a significant discount or, less commonly, a premium to its net asset value.

[They]bought the units of the closed-end funds trading at the widest discount from their underlying asset value, and then hedged out the market risk by shorting the securities that made up the mutual fund’s portfolio. Like the convertible arbitrage strategy, the closed-end fund arbitrage was indifferent to the direction of the market, generating profits as the gap between the unit price and the underlying value narrowed. It was not, however, classic riskless arbitrage.

As it was possible for a gap to open up between the price of the mutual fund unit and the underlying value of the portfolio, it was also possible for that gap to widen. When it did so, an investor who had bought the units of the fund and sold short the underlying portfolio endured short-term, unrealized losses until the market closed the gap. In the worst-case scenario, investors could be forced to realize those losses if the gap continued to widen and they couldn’t hold the positions. Sometimes they failed to meet a margin call or were required to cover the short position.

Unwilling to rely on the market to close the gap, * Once they had established their position, they lobbied to have the fund liquidated. The manager either acquiesced, * closed out the position for a gain, or the mere prospect of the manager’s liquidating caused the gap to wholly or partially close. The strategy generated good returns, but the universe of heavily discounted closed-end funds was small. * the far-larger universe [was] public companies with undervalued assets, in 1975.

UNDERVALUED STOCKS

* a decade of turmoil on the stock market had created a rare opportunity. After trading sideways for nine years, rampant inflation had yielded a swathe of undervalued stocks with assets carried on the books at a huge discount to their true worth. Recent experience had taught most investors that even deeply discounted stocks could continue falling with the market, but * they didn’t need to rely on the whim of the market to close the gap between price and intrinsic value. * “If we can be activists in an undervalued closed-end mutual fund, why can’t we be activists in a corporation with undervalued assets?’”

Mr. Icahn’s progression from arbitrageur and liquidator of closed-end funds to full-blown corporate raider started in 1976 with a distillation of the strategy into an investment memorandum distributed to prospective investors:

“It is our opinion that the elements in today’s economic environment have combined in a unique way to create large profit-making opportunities with relatively little risk. The real or liquidating value of many American companies has increased markedly in the last few years; however, interestingly, this has not at all been reflected in the market value of their common stocks. Thus, we are faced with a unique set of circumstances that, if dealt with correctly can lead to large profits, as follows: The management of these asset-rich target companies generally own very little stock themselves and, therefore, usually have no interest in being acquired. “They jealously guard their prerogatives by building “Chinese walls’ around their enterprises that hopefully will repel the invasion of domestic and foreign dollars. Although these “walls’ are penetrable, most domestic companies and almost all foreign companies are loath to launch an “unfriendly’ takeover attempt against a target company. However, whenever a fight for control is initiated, it generally leads to windfall profits for shareholders. Often the target company, if seriously threatened, will seek another, more friendly enterprise, generally known as a “white knight’ to make a higher bid, thereby starting a bidding war. Another gambit occasionally used by the target company is to attempt to purchase the acquirer’s stock or, if all else fails, the target may offer to liquidate.

“It is our contention that sizable profits can be earned by taking large positions in “undervalued’ stocks and then attempting to control the destinies of the companies in question by:

- a) trying to convince management to liquidate or sell the company to a “white knight.’

- b) waging a proxy contest.

- c) making a tender offer.

- d) selling back our position to the company.”

The “Icahn Manifesto” * — was Icahn’s solution to the old corporate principal-agency dilemma identified by Adolf Berle and Gardiner Means in their seminal 1932 work, “The Modern Corporation and Private Property.” The principal-agency problem speaks to the difficulty of one party (the principal) to motivate another (the agent) to put the interests of the principal ahead of the agent’s own interests.

* the modern corporation shielded the agents (the boards of directors) from oversight by the principals (the shareholders) with the result that the directors tended to run the companies for their own ends, riding roughshod over the shareholders who were too small, dispersed, and ill-informed to fight back.

*“It is traditional that a corporation should be run for the benefit of its owners, the stockholders, and that to them should go any profits which are distributed. We now know, however, that a controlling group may hold the power to divert profits into their own pockets.

“There is no longer any certainty that a corporation will in fact be run primarily in the interests of the stockholders.”

Mr. Icahn * likening the problem to a caretaker on an estate who refuses to allow the owner to sell the property because the caretaker might lose his job. His manifesto proposed to restore shareholders to their lawful position by asserting the rights of ownership. If management wouldn’t heed his exhortations as a shareholder, he would push for control of the board through a proxy contest in which competing slates of directors argued why they were better suited to run the company and enhance shareholder value. If he didn’t succeed through with that method, he could launch a tender offer or sell his position back to the company in a practice known as greenmail. Greenmail is a now-unlawful practice in which the management of a targeted company pays a ransom to a raider by buying back the stock of the raider at a premium to the market price.

Excerpted from “Deep Value: Why Activist Investors and Other Contrarians Battle for Control of Losing Corporations,” by Tobias E. Carlisle (Wiley, 2014).

[ix] Gunsmoke Season 4 episode 4. 1958.

‘’ IMEb and User Reviews. Monopoly. An unscrupulous Eastern businessman, a dandy from St Louis, Ivy, comes into Dodge and buys out all the freight wagons, intending to boost freight to monopoly prices. However there is one man, Joe Trimble, that refuses to sell his wagons. When Trimble’s house burns to the ground and his wife is killed, Marshall Matt believes that the man Ivy has hired as a bodyguard, Cam Speegle, who is responsible and knows that Cam is trouble.

Disclaimer: The author of each article published on this web site owns his or her own words. The opinions, beliefs and viewpoints expressed by the various authors and forum participants on this site do not necessarily reflect the opinions, beliefs and viewpoints of Utah Standard News or official policies of the USN and may actually reflect positions that USN actively opposes. John Choate © No claim in public domain or fair use.

Utah Standard News depends on the support of readers like you.

Good Journalism requires time, expertise, passion and money. We know you appreciate the coverage here. Please help us to continue as an alternative news website by becoming a subscriber or making a donation. To learn more about our subscription options or make a donation, click here.

To Advertise on UtahStandardNews.com, please contact us at: ed@utahstandardnews.com.

Comments - No Responses to “Part Eight. Micro-deflation, war, fire, corner, green mail, tariffs and dumping?”

Sure is empty down here...