Part five. Deflation, competition, trade war, free trade and dumping?

This is Part five of a series showing how inflation, deflation, barter, tariffs, taxes, postage, war, counterfeiting, history, economics, free trade, famine, dearth, climate, auctions, precious metals, religion, and education are combined into one great whole.

Part 5. Why study deflation, competition, trade war,

free trade and dumping?

Postage was eight cents when the President decreed wage and price controls in 1971, It would take 7 of these Missouri Statehood Sesquicentennial stamps to mail a letter in 2018.

Deflation causes its own inflation. Thus Deflation and inflation will both end in Barter. Barter reduces economic activity to 1/20th or 1/30th , or many fold, as is found in an exchange economy. Barter depends on the bargainers having something immediate to swap, which each needs or wants. Deflation can be a result of taxation and tariffs and levies. Deflation can result from trade, which incentivizes a transfer of wealth. Deflation may be caused by bad weather, war, dearth and natural disasters, each of which can cause shortages of money, leading to price collapse in food, eventual famine, shortages of trade, sometimes wage and price controls, or just wage controls. Deflation as a trade war tool includes dumping. Inflation as a trade war tool includes counterfeiting. Discounts and obsolete products or services result in a barter economy.

Inflation defined – Too much money, or medium of exchange, chasing too few products and services. Prices go up. Or, too few products and services chasing too much money. Money competes by paying higher prices. Bidding war or Auction.

Deflation defined – Too little money, medium of exchange, chasing too many products and services. Prices go down. Or, too many products and services chasing too few money. Products compete for sales by lowering prices. Gas wars or Discounts.

Barter defined – Trade without a medium of exchange. Few or no accepted means to store wealth. Goods and services exchanged for goods and services directly, without the intermediary of money. No money.

Money defined – A portable medium of exchange to conserve value. Ancient money included gold, silver, copper, jewels[i], pearls, frankincense, myrrh, ivory. Other moneys have included paper currency, cigarettes, tobacco, aluminum, ,

Postage was a dime (10 cents) after OPEC raised oil prices ten fold (1974). It would take 5 of these 1974 Veterans of Foreign Wars 75th Anniversary stamps to mail a letter in 2018.

Postage was a dime (10 cents) after OPEC raised oil prices ten fold (1974). It would take 5 of these 1974 Veterans of Foreign Wars 75th Anniversary stamps to mail a letter in 2018.

Deflation – Sources

1) Deflation caused by Commercial Domestic competitors. This is called over production. Ever seen a gasoline station price war? The gas wars began in Oklahoma with a price advertized at the 9/10th s or 9 mills on the dollar. The price wars date from the 1920s thru the 1950s when gas stations lured customers by price, 20.9 cents per gallon (instead of 21 cents), 15.9 cents per gallon (instead of 16 cents). Someone used the 9/10th cent in small print next to the big 20 or 15. This is carried over in 2018 with pricing at retail $39.99 instead of $40.

2) Deflation, caused by hot War, ends in a barter economy. During the world war and post war 1945 in Europe and Asia there was a barter economy. Widespread destruction of roads, bridges, homes, fields, forests, industry, wiped out means of growing food plus the destruction of money or exchange resulted in barter, plus forced and slave labor produced armaments and not luxuries or necessities. The Nazi money supplanted all the money in the conquered countries, and when the Nazi Germany surrendered in May 1945, there was no exchange, except actual silver and gold. Cigarettes were often cited for the black market, or silk ladies stockings, or just food. For another decade, classic art, whole libraries were sold from Europe to America to generate cash. The DeGolyer collection of History of Science, at the University of Oklahoma, was filled in by purchases of  European medieval libraries from 1946 to 1960s. Dublin council of Trade Unions founded in 1898, postage

European medieval libraries from 1946 to 1960s. Dublin council of Trade Unions founded in 1898, postage

3) Deflation from Foreign competitors –Trade war. Dumping of specific products in order to drive the industry of the target country out of business. Dumping is not providing food for free, as the U.S. Aide did, to countries unable to restore their food production in time to avoid starvation, as was the case in Europe and Asia in the aftermath of the Wars. Dumping is exporting at prices for sale in the receiving importing country below what the same product is sold in the manufacturing exporting country. Sometimes as low as a third of the domestic price, or lower. Dumping at lower prices is not efficient production if raw materials or labor are lower in the exporting country. Dumping is to drive competing nations out of the industry. Dumped foreign goods create a deflation in the receiving country, where the domestic industry cannot sell at a productive return on investment, pay wages, bestow health benefits, and maintain a distribution chain. Dumping is also illegal worldwide, see the footnotes on dumping from the Deseret News discussion of Geneva Steel. At one time, Utah had the largest steel production facility in the west, but it was eroded away by iron and steel dumping caused competitor deflation.[ii] The Geneva Steel story in Utah is typical of the deflation bankruptcies which occurred in steel and other industries. Geneva steel company, went bankrupt with a Billion dollars in assets ($600 million plant plus $400 million upgrade investment in the 1990s) sold its furnaces and parts to the Chinese for about three percent of the investment ($40 million, plus $40 million to cut up the plant and ship to China).[iii]

The piano industry disappeared in the United States, such as Wurlitzer and Baldwin pianos, undercut in price by inferior sounding boards (wood not properly cured or dried), but not obvious to the consumer. The electronic industry disappeared based on dumped imports, as have furniture, and clothing. The United States International Trade Commission keeps lists of antidumping and countervailing duty products. See for products and countries. [iv] https://www.usitc.gov/trade_remedy/731_ ad_701_cvd/investigations.htm

Postage was 13 cents at the time of the 1976 Bi-Centennial celebration. It would take 4 of these 1976 Spirit of 76 stamps to mail a letter in 2018

Postage was 13 cents at the time of the 1976 Bi-Centennial celebration. It would take 4 of these 1976 Spirit of 76 stamps to mail a letter in 2018

What about ‘Free trade?’

Free trade is an abbreviation for ‘tax free’ or ‘duty free’ trade. What consumer would object to tax free? Don’t we see ‘tax free’ at the airports? But those consumer retail shops have limits on how much product will be sold tax free. Tax free is not free of tax. Some one pays to cover the costs of society. Until the Income Tax act of 1916, the U.S. earned half of its revenues from tariffs on imports and exports, much of it ale and liquor. The income Tax amendment and act were specifically intended to provide the federal government a tax stream away from liquor, ahead of  Prohibition in 1920. 1953 – 5 cent centennial of Opening of Japan 1853 Commodore Matthew G. Perry U.S. Navy, opening foreign trade. The sceneis Tokyo bay with Mount Fuji in the distance.

Prohibition in 1920. 1953 – 5 cent centennial of Opening of Japan 1853 Commodore Matthew G. Perry U.S. Navy, opening foreign trade. The sceneis Tokyo bay with Mount Fuji in the distance.

Free trade supposedly allows trade between countries without troublesome tariffs (read taxes) and duties (read taxes) and levies (read taxes). The only trouble has been the trade has not been free, in that many countries have heavily subsidized their exports to America in order to dump products and disrupt competition, and if successful drive the American industry completely off the world market. Dumping is selling a product in America below, and usually far below, what the product is sold in the exporting manufacturing country. Dumping is a trade war. But in the recipient country, assume America, strong interests want cheap and cheaper products. Consider steel, the single consumer building one building wants cheap steel, and doesn’t worry about access to steel two generations from now, if the office building can be put up cheaply. The stock or shareholders would not complain, they would cheer on the bargain purchase, and argue it was a gift, and who doesn’t want to accept gifts? Investors want earnings reported every quarter, and the pressure is on to take the cheap dumped import. Who loses when the dumped product arrives on the shores? The labor unions, the employees, their families, the communities supported by the industry (Pittsburgh Pennsylvania, Salt Lake City Utah, Sand Springs Oklahoma). The targeted industry can appeal to the Federal International Trade Commission, which might study the complaint, and might make recommendations, and might react, and might have a backlog. The damage to the market creates a deflation, and population flees, and others pick up. The long term danger, besides turning thousands and millions out of jobs, is the permanent loss of a fundamental industry, perhaps for defense. Poland, having been occupied by Russia and Prussia from about 1780 to gaining its independence after the Great War (1814-1918) but it had no heavy industry (no manufacture of steel, cars, planes, ships) and was helpless, or defenseless, by 1939 when invaded. Poland had a barter economy where raising your own horse, mule or ox provided Polish transportation. Poland is one example, the number of countries without these basic industries are 100 or more around the world. A similar result obtained in the American civil war, (1861-1865) wherein the South, with a fraction, perhaps a sixth, of the industry of the northern states, and half of the population, and no navy, and limited iron and steel to foundry cannon, waged war with imported weapons and ammunition. The South had lots of cotton and forests for wood, but that wasn’t the same in the industrial revolution. Connecticut, for the north, was the manufacturing arms for rifles, cannon, and continued so thru the  Great War (1914-1918) and World War Two (1939-1945). 1959 – 8 cent World Peace Through World Trade. US Postage. The globe shows latitude and longitudes. Propaganda stamp with laurel spray.

Great War (1914-1918) and World War Two (1939-1945). 1959 – 8 cent World Peace Through World Trade. US Postage. The globe shows latitude and longitudes. Propaganda stamp with laurel spray.

These teams (steel, foundries, music, science, space) just can’t be assembled like pick up basketball or sand lot baseball. The space teams took a generation (1946-1966). Even more difficult were America’s teams assembled for the rocketry and space programs of the 20th century. They were cast aside in the 1990s.  1957 3 cent U.S. Postage America and Steel growing Together. Centenary of the Steel Industry. The Bessemer converter in 1857 increased in bulk steel production. Previously steel was so expensive it was reserved for knives, swords, and armour. Cast or wrought iron was used for boilers, train steam engines, and rails.

1957 3 cent U.S. Postage America and Steel growing Together. Centenary of the Steel Industry. The Bessemer converter in 1857 increased in bulk steel production. Previously steel was so expensive it was reserved for knives, swords, and armour. Cast or wrought iron was used for boilers, train steam engines, and rails.

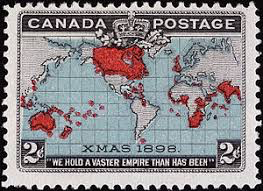

2 cent Canada Postage, XMAS 1898 We hold a vaster empire than has been. Mercator Projection. “A Song of Empire”, published as the Jubilee Ode. “We hold a vaster Empire than has been!

2 cent Canada Postage, XMAS 1898 We hold a vaster empire than has been. Mercator Projection. “A Song of Empire”, published as the Jubilee Ode. “We hold a vaster Empire than has been!

Nigh half the race of man is subject to our Queen! Nigh half the wide, wide earth is ours in fee! And where her rule comes all are free.And therefore ’tis, O Queen, that we, Knit fast in bonds of temperate liberty, Rejoice to-day, and make our solemn Jubilee.

In the Spring of 2018, the President announced tariffs on steel and aluminum. Those condemning the tariffs want more cheap imports for their consumer constituency, who want standard of living on the cheap. Media wrung their digital fingers about an impending trade war. The President replied, ‘we’ve already lost the trade war.’ Those praising the President’s tariffs are remnants of once mighty industries, or mighty labor unions, or concerned for national security going forward. When the United States mobilized after Pearl Harbor (1941), it was able to do so because the labor forces still had managers and some labor who knew how to train new labor (mu ch of it women). The designs were known and the idle plants could be reopened after only a decade of depression (1932 to 1941).  1973 8 cent The Boston Tea Party, Bicentennial. The tax on the tea trade prompted the tea party, which closed the port of Boston, with the Brits sending occupying troops on their way to Lexington and Concord. As for the tariffs, there never has been free trade. Countries don’t compete by selling overseas for the cost of the domestic price at home plus transportation. Why? Because they are priced out of the foreign export market. There has always been a trade war, and there always will be. And what is the penalty if caught dumping? Fines? The fines go to the government, not to the poor already put out of business. Such are deflation and dumping tariffs.

1973 8 cent The Boston Tea Party, Bicentennial. The tax on the tea trade prompted the tea party, which closed the port of Boston, with the Brits sending occupying troops on their way to Lexington and Concord. As for the tariffs, there never has been free trade. Countries don’t compete by selling overseas for the cost of the domestic price at home plus transportation. Why? Because they are priced out of the foreign export market. There has always been a trade war, and there always will be. And what is the penalty if caught dumping? Fines? The fines go to the government, not to the poor already put out of business. Such are deflation and dumping tariffs.

On May 31, this headline came from the White House 1600 Daily.

China has consistently taken advantage of America’s economy

For many years, China has used unfair trade and industrial practices—including “dumping,” discriminatory barriers, forced technology transfer, over capacity, and industrial subsidies—that champion Chinese firms and make it impossible for many U.S. firms to compete on a level playing field.

The costs of these policies to American industry keep piling up:

| • | China’s intellectual property theft costs U.S. innovators billions of dollars each year |

| • | China accounts for 87 percent of the counterfeit goods seized coming into America |

| • | Beijing has banned imports of U.S. agricultural products such as poultry, cutting off America’s ranchers and farmers |

| • | The United States charges a 2.5 percent tariff on Chinese cars, while China maintains a 25 percent tariff on cars from America |

President Trump has taken long overdue action to address the source of the problem. Part of the solution includes imposing a 25 percent tariff on $50 billion of goods imported from China that contain industrially significant technology, including those related to the “Made in China 2025” program. The Administration is also implementing specific investment restrictions and enhanced export controls.

4) Deflation by Commercial interests sending money out of the area. Remember too little money is chasing too many goods, so the price of goods go down, and more money is hoarded because everything will be cheaper tomorrow, next week, next month, until next year, and so forth. Here is an explanation from Heber j. Grant from 1919 comparing circulating money to circulating blood, the loss of either made the host sicker.[v] See the discussion for export controls on currency. President Grant also explained how home money stays home.[vi]

5) Deflation by Earthquake, flood, hurricane, typhoon, destruction – Natural disasters create both a shortage of products because of the destruction, and a shortage of labor to heal or rebuild. But if the people flee or are killed, there is no market for which to rebuild.

Hurricane and flood- A 29 August 2005 hurricane – Katrina – overwhelmed the levees holding back water from New Orleans which flooded half of the city, drowning 1600 and displacing hundreds of thousands of refugees. The rebuilding generated inflation.[vii] 80% of New Orleans was flooded. Tens of thousands of residents who were left in the city were rescued, but many stayed in shelters — including the Louisiana Superdome — for days. Officially, 1,500 people died in Louisiana, but there were many more never accounted for. Tens of thousands of people left New Orleans and never returned, and in 2006, the Census Bureau estimated the population was just 223,000. A year later, 32,000 people returned, which brought the city’s population to just 56% of pre-Katrina levels. http://worldpopulationreview.com/ us- cities/new-orleans-population/

6) Think ahead to disaster. Manhattan world trade centers destroyed Sept 11, 2001. The DJIA Stock market dropped a thousand points over the next several months. The stock market is to promote the economy, see Senator Edmund Muskie’s concise explanation.[viii] See the 45 cent special flag stamp of the firemen draping the flag at the Pentagon.

1923 One Millarde (BILLION) Mark note with red endorsement to raise amount. German hyper inflation. Eintausend (thouand) mark Reichsbanknote December 1922.

1923 One Millarde (BILLION) Mark note with red endorsement to raise amount. German hyper inflation. Eintausend (thouand) mark Reichsbanknote December 1922.

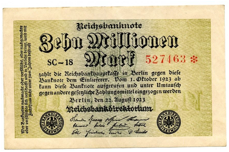

October 1, 1923 Reichebanknote, ten million mark.

October 1, 1923 Reichebanknote, ten million mark.

One hundred thousand mark Reichebanknote, 100000 Mark.

One hundred thousand mark Reichebanknote, 100000 Mark.

7) Deflation from hyper inflation. Germany October 1923 hyper inflation, currency  went up many million times. Lessons learned? Wiped out savings and pensions. People lost faith in frugal living. Renters were destroyed, but land owners and stock market players scored. People with fixed debt who were able to sell other assets and pay of the debt with cheap money scored. The wealth was moved around the country away from wage earners to property owners.

went up many million times. Lessons learned? Wiped out savings and pensions. People lost faith in frugal living. Renters were destroyed, but land owners and stock market players scored. People with fixed debt who were able to sell other assets and pay of the debt with cheap money scored. The wealth was moved around the country away from wage earners to property owners.  The German stock market went up with the inflation, a million or billion fold. Confidence in government was destroyed among the losers. No starvation, as the hyper inflation lasted weeks. Cheap Marks Paid off debts and loans with worthless paper. Cheap Marks Paid off bonds fast. Wiping out savings lead to distrust of government. Nazi Germany 1933-1945 limited exporting of wealth. Refugees fleeing Germany could only take a few hundred marks, and sending marks out of the country was limited. Lesson to the German people! It was pointless to save money or plan for the future. Lessons to the Germans, don’t trust your banks, your money is the Governments and there are ways for the Government seize it, outside of taxation. Lessons to the Germans, on collecting of funds, the Government simply printed the currency and paid it out. The Reiche Government’s officers and political leaders will take wealth as they wish, or pay as they wish, without telling you.

The German stock market went up with the inflation, a million or billion fold. Confidence in government was destroyed among the losers. No starvation, as the hyper inflation lasted weeks. Cheap Marks Paid off debts and loans with worthless paper. Cheap Marks Paid off bonds fast. Wiping out savings lead to distrust of government. Nazi Germany 1933-1945 limited exporting of wealth. Refugees fleeing Germany could only take a few hundred marks, and sending marks out of the country was limited. Lesson to the German people! It was pointless to save money or plan for the future. Lessons to the Germans, don’t trust your banks, your money is the Governments and there are ways for the Government seize it, outside of taxation. Lessons to the Germans, on collecting of funds, the Government simply printed the currency and paid it out. The Reiche Government’s officers and political leaders will take wealth as they wish, or pay as they wish, without telling you.

8) Seizing bank accounts. A form of inflation is when the Government seizes bank accounts. In the U.S. this is done for criminal punishment, to seize bank accounts, cash, airplanes, houses, cars, anything associated with a criminal enterprise. It is also used to seize domestic funds held for overseas governments, and is called sanctions.

On March 25, 2013, The Guardian (London) ran headlines ‘Cyprus bailout deal with EU closes bank and seizes large deposits. Draconian terms aimed at keeping Cyprus in eurozone include closure of second-largest bank and big losses for wealthy savers.’

Those with deposits of less than €100,000 (£85,000) will be spared, but those with more than €100,000 – many of them Russian – will lose billions of euros under draconian terms aimed at preventing the Mediterranean tax haven becoming the first country forced out of the single currency. The deal is expected to wreak lasting damage on the Cypriot economy, which has grown reliant on offshore banking and Russian money. Analysts said Cyprus could see its economy contract by 10% or more in the years ahead. Laiki, or Cyprus Popular Bank, is to be closed. Its €4.2bn in deposits over €100,000 will be placed in a “bad bank” and could be wiped out entirely. Those with smaller deposits will see their accounts transferred to Bank of Cyprus. Cyprus will inherit a €9bn debt Laiki had with the European Central Bank (ECB).

9) Bank seizer by debt collectors is a form of micro deflation. Whatever the term may be – to wit garnishment, lien, seizure, collection, judgment, or bankruptcy – the effect is the same, a wiping clean of the money available for chasing products and services. This is a micro deflation for a single entity, or person, and bankruptcies may run 800 thousand to a million one hundred thousand year in the U.S. If the bankruptcy is a formerly large company, such as 2008 Lehman Brothers Holdings ($691B), 2009 General Motors (483B), 2009 Chrysler ($39B) , Penn central, 2001 Enron ($65B), 2001 Pacific Gas and Electric ($36B), 2009 Bernie Madoff’s Ponzi scheme[i] ($64B), 1987 Texaco ($35B) the micro deflation can affect, or ruin, tens of thousands, or millions of people.[ii]

[i] Wikipedia summarized the Madoff scandal as involving $64 Billion reported in accounts, with a confiscations of Madoff’fs art and assets and loot worth about $9 to $11 billion, for a loss of $53 plus billion. Madoff had 35 sets of watches and cufflinks. The offshore funds were kept secret by the SEC to prevent being seized by foreighn regulations and foreign creditors.

[ii] Also 2008 Washington Mutual ($327B), 2002 Worldcom Inc ($103B), 2009 CIT Group ($71B), 2002 Conseco ($61B), 2011 MF Global ($41B), 2009 Thornburg Mortgage ($36B), 1988 Financial Corp of America ($33B) , 2005 Refco ($33B), 2008 IndyMac Bancorp ($32B), 2002 global Crossing ($30B), 1991 Bank of New England ($29B), 2009 General Growth Properties ($29B), 2009 Lyondell Chemical ($27B), 2005 Calpine ($27B)

If the loss is a company which is the major employer in a town, the effect can be town, state or region wide.

To limit loss of confidence, sometimes due to bankruptcies, other times due to the times, the Congress organized the 1933 FDIC (Federal Deposit Insurance Corporation), the 1974 PBGC (Pension Benefit Guaranty Corporation (PBGC), 1970 SIPC (Securities Investor Protection Corporation)[xi], 2002 TRIA (Terrorism Risk Insurance Act), 1954 Federal Employees’ Group Life Insurance (FEGLI) Program, 2004 FEDVIP (Federl Employee Dental and Vision Insurance Program)

10) U.N. United Nations embargoes and financial sanctions. This is a form of micro deflation, by reducing economic activity in a target country. The United Nations uses asset freeze, publicly targeting WMD (weapons of mass destruction)[xii], conventional weapons, mercenaries, contraband.  Avoidance of asset seizure comes under categories of bilateral interactions, budgetary, manipulations, barter deals, appropriations, confiscation, bribing. 6 cent United Nations 25th anniversary U.S. Postage. 1970.

Avoidance of asset seizure comes under categories of bilateral interactions, budgetary, manipulations, barter deals, appropriations, confiscation, bribing. 6 cent United Nations 25th anniversary U.S. Postage. 1970.

http://comcapint.com/comcapint/asset-freeze-and-other-economic-sanctions/

Barter Is used to avoid sanctions, and returns the country’s economy to a minimalist existence. Barter is useful for oil, food, energy, medicine, slaves and access. Lists of U.N. embargoed counties are on Pitt.edu http://www.export.pitt.edu/embargoed-and-sanctioned-countries ‘’Embargoes sanctions (CRIMEA – REGION OF UKRAINE, CUBA, IRAN, NORTH KOREA, SUDAN (Revoked 2017)[xiii] and SYRIA) prohibit ALL transactions (including imports and exports) without a license authorization. ‘’ Circa 2017. The U.S. Office of Export Controls Services provides licenses. These could be described as ‘hot spots’ on the map, and include 3 dozen countries of the 15 dozen member states of the United Nations.

Sanctions create a shortage of products and services for import, thus driving up the prices, and at the same time creating a deflationary economy, reducing the country to barter. Thus trade can be another tool of warfare, usually with a savings in personnel and equipment. This is an example of state micro deflation.

[i] Jewels mentioned in Aaron’s breastplate of judgment included sardius, a topaz, a carbuncle, an emerald, a sapphire, a diamond, ligure, an agate, an amethyst, beryl, and an onyx, and a jasper. Exodus 28:17-21.

[ii] Dumped foreign steel is no boon to American consumers, Deseret News February 28, 1999, by Greg Mastel.

https://www.deseretnews.com/article/682900/Dumped-foreign-steel-is-no-boon-to-American-consumers.html

A chorus of critics has attacked the [1999] decision by the U.S. Commerce Department to offset the impact of dumped imports of steel from Japan, Brazil and Russia, imports sold at below their cost of production or below their home market price. The critics argue that this unfairly priced steel should be accepted as a gift to consumers. Rather than imposing duties or taking other measures to raise the price to reflect its true market value, the United States should accept dumped steel gladly and congratulate itself on being a bargain hunter. This is tremendously short-sighted. This gift to consumers comes with some very costly strings attached, including the loss of domestic steel companies like Geneva Steel*.

First, * dumping is against the law, and U.S. authorities are obligated to act. Ironically, some * argue for ignoring the law*. The United States has had laws against dumping for most of this century. * [A]nti-dumping laws,* are fully endorsed by the World Trade Organization. Under U.S. law, any industry that can prove it is being forced to compete with dumped imports it feels are injuring its economic health can demand that the U.S. government take action to halt the dumping. * {S]teel is being dumped. All of the countries * have been found to be dumping steel in the U.S. market in previous years. Desperate for hard currency and with little domestic market, Russian steelmakers have slashed steel prices far below their cost of production. Japanese steelmakers routinely export steel at far less than the price they charge Japanese domestic buyers; often, the price disparity amounts to a difference of hundreds of dollars per ton. Brazilian steelmakers have * dumping and subsidizing exports of steel; more than a half dozen successful complaints of unfair trading have been made against Brazil in recent years.

Second, the U.S. government should seek a level playing field for its companies. The world steel market is deeply distorted by subsidies, trade barriers, cartels and national industrial policies. Japan, Brazil, Russia and Korea, * build up their domestic steel industry and encourage exports; dumping is the frequent result {T]he United States does little to aid its steel industry, tariffs are low, cartels are prohibited, and subsidies are quite small.

If the United States did not level the playing field by imposing duties on dumped imports, U.S. steel companies would not be able to compete. U.S. investment, production and employment in the steel industry would all decline precipitously. * [C]onsumer benefits of dumping were rapidly outweighed by the negative impact of the economic losses in the steel industry.

There is also a political dimension *, free trade is not possible without fair trade. The American public is already suspicious of the merits of free trade. If the U.S. government does not act even in the face of demonstrated unfair trading tactics on the part of its trading partners, * an open U.S. market [will end].

Finally, the steel industry is an internationally competitive and valuable component of the U.S. economy. In previous years, the U.S. steel industry had * created a highly competitive industry with some of the lowest production costs in the world. * Further, steelworkers are so productive that they are able to command wages almost twice as high as those of the average U.S. job.

Despite its critics, the Clinton administration can and should vigorously enforce its trade laws against dumped steel from Russia, Japan, Brazil and other countries that dump steel. Those who argue that dumped steel is a gift to consumers simply ignore the larger picture. One of life’s lessons is that deals that are too good to be true almost always are. *

Greg Mastel is vice president and director of studies at the Economic Strategy Institute in Washington, D.C., and an author of Leveling the Playing Field: Anti-dumping and the U.S. Steel Industry.

[iii] Geneva gets Chinese offer. By Dave Anderton

Deseret Morning News Published: December 31, 2003. Less than 10 cents on the dollar. That’s what a Chinese company is offering to pay for bankrupt Geneva Steel’s equipment.

According to court documents, Qingdao Iron and Steel Group Co. said it is willing to buy the defunct company’s assets for $35.3 million in cash – The offer is less than 10 percent of the more than $400 million the Vineyard-based company poured into a modernization campaign to upgrade its facilities during the 1990s. * Yet so far, it’s the company’s best offer. *Even though Geneva has signed an agreement to sell its equipment to Qingdao, Geneva is reserving the right to accept a higher offer should one be made before Jan. 30, the deadline for competing bids.

* “The steel industry in China right now is expanding at a phenomenal rate. It’s expanding at about 10 percent per year when the rest of the world is on average about 1 percent a year. The primary buyers for steel equipment these days are in China.”

The sale to Qingdao includes the plant’s core production line: the steelmaking facility known as Q-BOP, a slab caster that turns liquid steel into a slab, a rolling mill which rolls the steel into plate or sheet, and a plate finishing line. Used steel equipment appeals to the Chinese steel mills, Johnsen said, because it is cheaper than new equipment and the lead time for installing the used equipment is shorter.

* Geneva’s roughly 2,500 unsecured creditors who are collectively owed about $35 million,

“There are still other assets to be sold,” amount of substantial value in the emissions credits, in the water rights and in the real property*.”

Under bankruptcy rules, secured creditors have a higher priority to be paid over unsecured creditors. Geneva sold its pipe mill equipment for $1.45 million to a company based inIndia. [A]bout 30 percent of the cost is the equipment and the rest involves engineering, civil work and installation.” Geneva Steel has been in Chapter 11 bankruptcy reorganization since January 2002, the second time it filed for bankruptcy. Geneva had been a major employer and tax-base provider in Utah County since it was built by the U.S. government during World War II. At one point under Cannon’s tenure, the mill employed 2,850 people. Chinese firm gets OK to buy Geneva assets By Dave Anderton

Deseret Morning News Published: February 5, 2004

Wednesday’s sale to Qingdao includes the plant’s core production line:

- The steelmaking facility known as Q-BOP.

- A slab caster that turns liquid steel into a slab.

- A rolling mill that rolls the steel into plate or sheet.

- A plate finishing line. Qingdao city [has] 7 million people*. China is expected to consume 300 million tons of steel [1999], Schiefer said, producing three times the amount of steel as the United States.

- Since 1989, [Geneva Steel] has spent more than $645 million for the plant and equipment to modernize and maintain its production facilities,*.

- Despite the * upgrades, Geneva fell on hard times by the mid-1990s after a flood of foreign steel imports made it nearly impossible to compete.

- January 2001, a $110 million term loan was 85 percent guaranteed by the federal government.

- *the dismantling, transport and reassembly of the equipment could take 18 months to 24 months to complete at a cost greater than the $40 million Qingdao is paying for the equipment. *buying used steelmaking equipment is cost-effective, and it is faster to install than new equipment.

- Geneva was built by the U.S. government due to fear of a World War II Pacific Coast invasion or closure of the Panama Canal. Construction on the plant lasted from 1941 to 1944. The federal government sold the plant after the war to U.S. Steel.

- during the early 1960s, the company employed nearly 8,000 workers,

- Geneva was [Utah]’s biggest employer,* accounting for 1 percent of the total personal income of Utah, the highest of any nongovernmental entity, including Kennecott

[v] Home Manufactures and Industries An Illustration of the Financial Advantages in Purchasing Home-Made Goods — Twelve Hundred and Fifty Factories In Utah Prepared to Supply Demand. BY President HEBER J. GRANT Utah Payroll Builder, 1919. “The way I figure, the wool that would have made a suit of clothes, if shipped out of our country, will bring back about one dollar to help enrich the community ; but if that wool were put into cloth, and the cloth into a suit of clothes, at least twenty-five dollars of the value of that suit would remain here and would be received by somebody for labor or in the increased value. We are told that a dollar is to the world of finance what a drop of blood is to the body,—that it is the circulating medium. I understand from doctors, that the heart handles about four ounces of blood every time it beats ; that it beats seventy-eight times a minute with the average individual—call it eighty, in order to make it easy, and we have twenty pounds of blood handled every minute, or practically every drop of blood in the body. Multiplying that by sixty, and then multiply it again by twenty-four. Of course, they say it does not beat quite so lively while you are asleep ; but it amounts to more than ten tons, every twenty-four hours; and, yet, there is only twenty pounds of it. It is going and going, circulating and circulating. It is the same with money. Where the money goes out of a community, to import goods into that community, the circulating medium is weakened; the life blood is taken away, and the community becomes about as sickly as the individual would be if you should bleed him, and take half of his blood out of him. He would have a pretty light color.

[vi] Home Manufactures and Industries An Illustration of the Financial Advantages in Purchasing Home-Made Goods — Twelve Hundred and Fifty Factories In Utah Prepared to Supply Demand. BY PRESIDENT HEBER J. GRANT Utah Payroll Builder, 1919. Quoting Bishop George Farrell ‘’ I saw a man who had made some shoes for my children, and I paid him $5.00. The man who got the five dollars for these home-made shoes, handed it to another man ; he handed it to another; he to another; and when the fourth man got it, he handed it back to me, and figuratively speaking, I put my homemade shoes back in my pocket. Now,’ he said, ‘that five dollar bill paid $25.00 worth of debts quicker than it takes me to tell you of it; but if I had bought imported goods, there would have been five of us looking for five dollars.’ “I remember, on one occasion, going to one of our merchants here in the city, trying to sell him a box of soap, and he said : ‘Oh, I make as much profit on the imported article, and it is established ; I don’t have to talk to try to get rid of it ; and I don’t care to buy your soap.’ ‘Well,’ I said, ‘you, undoubtedly, make the people pay you at least 25 per cent profit, so I will just give you 25 per cent if you will buy my soap ; that is, I will take orders on your store.’ Well, you know, he liked himself the best, and of course he wanted that 25 per cent, and so he was willing to help boost for home-manufacture. He would do it if he was paid for it, otherwise he would not. Now, I took the trouble to keep track of those orders that came to me—who got them, what they did with them, and then find out what that party did with them. “By keeping track of these orders, we found they went through seven hands during the week, before they got into the merchant’s till.—so they did one hundred per cent a day of work, and did enough in six days to be able to rest on Sunday If the imported article had been purchased instead of the home-made article seven hundred per cent of debts, in one week—equal to seven times the sum of the home-made goods bought—would not have been cancelled- Bee Hive soap.”

[vii] Many projects are hamstrung by the soaring costs of construction and insurance, while federal funding has been slow to flow to cities. Other economic indicators are down — such as population, employment and housing supplies. But much of New Orleans still looks like a wasteland, with businesses shuttered and houses abandoned. Basic services like schools, libraries, public transportation and childcare are at half their original levels and only two-thirds of the region’s licensed hospitals are open. Rental properties are in severely short supply, driving rents for those that are available way up. Crime is rampant and police operate out of trailers.

Along Mississippi’s 70-mile shoreline, harsh economic realities also are hampering * Gulf Coast rebuilding * the federal government has committed a total of $114 billion to the region, $96 billion of which is already disbursed or available to local governments. Most of it has been for disaster relief, not long-term recovery. * it is local officials’ fault, particularly in Louisiana where the pace has been slower, if money has not reached citizens. *

[100 year is an arbitrary line with no relevance to 100 years of records of floods or rain or any weather or climate history. It is an arbitrary height above the river bed, but still in the geological flood plain.] infrastructure repair and home rebuilding — are shared responsibilities with local officials or entirely the purview of state and local governments [Locals want to rebuild in flood plains below the levy and river crest.]

Bush assures hurricane-ravaged New Orleans: ‘We’re still paying attention’ By Jennifer Loven Associated Press Published: August 29, 2007

[viii] In 1970, Senator Edmund Muskie stated:

“The economic function of the securities markets is to channel individual institutional savings to private industry and thereby contribute to the growth of capital investment. Without strong capital markets it would be difficult for our national economy to sustain continued growth…. Securities brokers support the proper functioning of these markets by maintaining a constant flow of debt and equity instruments. The continued financial wellbeing of the economy thus depends, in part, on public willingness to entrust assets to the securities industry.”[9]

https://en.wikipedia.org/wiki/Securities_Investor_Protection_Corporation

[ix] Wikipedia summarized the Madoff scandal as involving $64 Billion reported in accounts, with a confiscations of Madoff’fs art and assets and loot worth about $9 to $11 billion, for a loss of $53 plus billion. Madoff had 35 sets of watches and cufflinks. The offshore funds were kept secret by the SEC to prevent being seized by foreighn regulations and foreign creditors.

[x] Also 2008 Washington Mutual ($327B), 2002 Worldcom Inc ($103B), 2009 CIT Group ($71B), 2002 Conseco ($61B), 2011 MF Global ($41B), 2009 Thornburg Mortgage ($36B), 1988 Financial Corp of America ($33B) , 2005 Refco ($33B), 2008 IndyMac Bancorp ($32B), 2002 global Crossing ($30B), 1991 Bank of New England ($29B), 2009 General Growth Properties ($29B), 2009 Lyondell Chemical ($27B), 2005 Calpine ($27B)

[xi] Wikipedia quotes President Richard Nixon, December 30, 1970. It protects the small investor, not the large investor, since there is a limit on reimbursable losses. And it assures that the widow, the retired couple, the small investor who have invested their life savings in securities will not suffer loss because of an operating failure in the mechanisms of the marketplace.””

[xii] This term or abbreviation for dangerous destructive creations has changed over time. NBC (1940s-1980s) for Nuclear, Biological and Chemical. NBC was also a trade mark of a major television network in the U.S. NBC (National Broadcasting Corporation. The term non-conventional weapon (NCW) was used for a while,[‘strategic weapons’] but didn’t explain itself, yet still meaning nuclear bombs. ‘Atomic weapons’, ‘nuclear weapons’ were descriptive. ‘Asymmetrical warfare’ includes anthrax and air craft as weapons. CBR is the abbreviation for chemical, biological, radiological. CBRNE is Chemical, Biological, Radiological, Nuclear, and Explosive.

The opprobrium of these is they are uncontrolled by man, and do not discriminate between military and civilian targets. The wind can blow the poison gas over the enemy, or change and blow back over the attacker. Germs (biologics) can be spread by insect vectors, water, humans, or left in grass and meadows for years, long after the conflict is over. Nuclear destroys (or cooks) everything within the blast or fireball zone.. Radiation destroys all life forms, even if preserving property.

[xiii] https://www.treasury.gov/resource-center/faqs/Sanctions/Pages/faq_other.aspx#revocation has a thousand lines explaining the Sudan Sanctions revoked in 2017

Disclaimer: The author of each article published on this web site owns his or her own words. The opinions, beliefs and viewpoints expressed by the various authors and forum participants on this site do not necessarily reflect the opinions, beliefs and viewpoints of Utah Standard News or official policies of the USN and may actually reflect positions that USN actively opposes. John Choate © No claim in public domain or fair use.

Utah Standard News depends on the support of readers like you.

Good Journalism requires time, expertise, passion and money. We know you appreciate the coverage here. Please help us to continue as an alternative news website by becoming a subscriber or making a donation. To learn more about our subscription options or make a donation, click here.

To Advertise on UtahStandardNews.com, please contact us at: ed@utahstandardnews.com.

Comments - No Responses to “Part five. Deflation, competition, trade war, free trade and dumping?”

Sure is empty down here...