Part four. Inflation Coins and currency?

This is Part four of a series showing how inflation, deflation, barter, tariffs, taxes, postage, war, counterfeiting, history, economics, free trade, famine, dearth, climate, auctions, precious metals, religion, and education are combined into one great whole.

Part 4. Why study Inflation Coins and currency?

11) Coins and currency have the purpose to preserve value for economic activity, so the value of many products and services can be accumulated. Money is a medium of exchange. The common ones were gold, silver, and copper, and at other times pearls, cowry shells, or ivory. Other jewels had ready value, such as diamond, sapphire, topaz, and opal. But these in large amounts, are bulky and heavy,  so letters of credit were introduced, and later paper currency. The U.S. currency denotes ‘Legal tender for all debts public and private.’ You can pay your taxes with the paper, and have to accept it for payment of bills, debts, bonds.

so letters of credit were introduced, and later paper currency. The U.S. currency denotes ‘Legal tender for all debts public and private.’ You can pay your taxes with the paper, and have to accept it for payment of bills, debts, bonds.  Until 1964, the U.S. offered ‘silver certificates’ backing each $1, $2 and $5 bills, with so much silver. See it on the Continental currency of 1780 (backed by Spanish milled dollar).

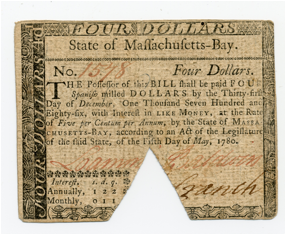

Until 1964, the U.S. offered ‘silver certificates’ backing each $1, $2 and $5 bills, with so much silver. See it on the Continental currency of 1780 (backed by Spanish milled dollar).

1780 Four Dollars. SN 1578 May 5th Bill 4 Spanish milled dollars 31 Dec 1786 4% interest Massachusetts-Bay Baldwin *ranch. The United States ensure the Payment of the within Bill and will draw Bills of Exchange for the Interest annually, if demanded, according to a Resolution of Congress of the 18th of March, 1780. Printed by Hall and Sellers.

1780 Four Dollars. SN 1578 May 5th Bill 4 Spanish milled dollars 31 Dec 1786 4% interest Massachusetts-Bay Baldwin *ranch. The United States ensure the Payment of the within Bill and will draw Bills of Exchange for the Interest annually, if demanded, according to a Resolution of Congress of the 18th of March, 1780. Printed by Hall and Sellers.

Until 1934, the U.S. offered ‘gold certificates’ backing $20 and $100 bills with so much gold.  As long as the person you are dealing with accepts your medium of exchange – currency – you can do trade. You might offer Yen, Rubles, pounds, marks, cruzeros, from another nation. These are not mandatory to be accepted in the U.S. for trade or legal tender.

As long as the person you are dealing with accepts your medium of exchange – currency – you can do trade. You might offer Yen, Rubles, pounds, marks, cruzeros, from another nation. These are not mandatory to be accepted in the U.S. for trade or legal tender.  The smaller the country trying to push its currency, the fewer takers, unless you have something unique – the spice islands of Java, or tea, or cocoa, or coffee. In the 18th century, Virginia priced everything in pounds of tobacco (not pounds sterling or silver), estates, products, taxes were paid in credits for tobacco.

The smaller the country trying to push its currency, the fewer takers, unless you have something unique – the spice islands of Java, or tea, or cocoa, or coffee. In the 18th century, Virginia priced everything in pounds of tobacco (not pounds sterling or silver), estates, products, taxes were paid in credits for tobacco.

Bit Coin currency. – This is outside any government, but a result of the software, and a multi billion dollar annual gaming industry. The gamers, playing on line, by acquiring (purchasing with credits or cash) software tools, they continue to enjoy their past times. About 10 to 20 million players can trade these tools and credits – they don’t need to convert the credits into cash in and out, making It subject to taxes and bank commissions . Then get people to have the option to buy into credits or bit coins with currency and you have an auction price. Get enough people to bid, in a market, and you have an industry. This is similar to the 17th century ‘Dutch tulip bubble’ when tulip bulbs rose to prices equivalent to a decade of labor. The collapse of the tulip bulb prices ruined some, whose ruin ruined others. This caused bankruptcies, and deflation resulted, inflation followed by deflation? No, the deflation mirrored the inflation simultaneously. It is a realignment of wealth.

12) Postage rates in US from 1780s, to airmail 1920s, to post World War Two. 2 cents to 49 (2018) cents, now forever stamps increase with the 1st class rate.

Inflation causes its own Deflation, and deflation eventually results in a barter economy. Governments have not figured out how to tax or inflate away education or love (both portable). Government has figured how to tax-

Not Portable – land (assessments, levies and liens), light and air (Scotland had a tax on windows, which could be observed from the street by the tax collectors – ultimately resulting in the bricking in and closing of windows), children and wives (head taxes or per capita tax).

Portable – produce (trade) , trade (portable -tariffs and sales tax), travel (toll roads, tax on fuel), utilities (taxes on delivery, usually end consumption), luxuries (transfer), estates – death – old age (inheritance, transfer tax of property), health (services, pills,) , religion (souls) and charity (income tax), salt (trade tariffs and land tax), water (delivery and consumption). Labor (wage tax).

The auction market. Inflation has been defined as too much money chasing too few products or services – driving up the price of the products and services, with the result the money purchases less and less. This describes an auction market.

Four Dollars State of Massachusetts Bay. No 1578 Four Dollars. The Possessor of this Bill shall be paid Four Spanish milled Dollars by the 31st Day of December, 1786, with interest in like money, at the Rate of 4 per centum per annum, by the State of Massachusetts-Bay, according to an Act of the Legislature of the said State, of the 5th Day of May 1780

Four Dollars State of Massachusetts Bay. No 1578 Four Dollars. The Possessor of this Bill shall be paid Four Spanish milled Dollars by the 31st Day of December, 1786, with interest in like money, at the Rate of 4 per centum per annum, by the State of Massachusetts-Bay, according to an Act of the Legislature of the said State, of the 5th Day of May 1780

13) Inflation, purchasing power declines going forward in time. Today my $5 will buy 11 postage stamps and mail 11 letters, tomorrow – 2nd day – $5 will buy 9 postage stamps and mail 9 letters, 3rd day $5 will buy 8 postage stamps and mail 8 letters. Seeing that, I’ll buy as many postage stamps today, and use them up tomorrow and the 3rd day. I might even borrow money, say $5, to buy 20 postage stamps, to last for weeks or months. Result, business activity speeds while people spend to capture the purchasing power of their money. So in 1955, my $5 bought 166 first class postage stamps and mailed 166 letters. But not everything moves in price, nor moves the same amount. While postage stamp prices moved up, the cost of personal hand calculators moved down (in 1974 $500 would buy 5,000 1st class stamps and mail 5,000 pieces of half ounce envelope mail) or 1 hand HP [Hewlett Packard] hand calculator, by 2018 the same $500 would buy 1,000 1st class stamps and 50 hand calculators. Or another comparison, the price for 5,000 stamps ($2500) in 2018 would also purchase 250 Hand calculators. The ratio of Stamp to hand calculator changed from 5,000 to 1 (1974) to 20 to 1 (2018), the price for stamps went up and the price for hand calculator moved down in 44 years.

If you had an extra $500 in 1974 and knew what would happen over the next 44 years until 2018, what should you do? Buy postage stamps? or buy hand calculators? The loss of purchasing power for stamps was 500 percent, the increase of purchasing power for calculators was 5000 percent, so the best was to stay in cash for 44 years and then buy hand calculators.

Germany 1923 hyper inflation. Spend your pay check for the week’s rent and week’s groceries.

14) War inflation is described in the Bible, an army surrounded Jerusalem about 7th century B.C., wherein a pile of bird dung could be sold for silver pieces. The buyer hoping the bird dung might contain undigested seeds, which could be dug thru, to eat. This is a simple example of how inflation causes its own deflation. The price of food became so high (sometimes called dear) it was inflation. But it also caused a deflation of the buying power of silver, which had lost so much purchasing power it was buying bird poop (dung). The food (poop) was inflated, and the silver was deflated. Inflation of bird dung? Cannibalism, war, famine.

Bible inflation. 2 Kings Chapter 6. 25 And there was a great famine in Samaria: and, behold, they besieged it, until an ass’s head was sold for fourscore pieces of silver, and the fourth part of a cab of dove’s dung for five pieces of silver. [ This famine was due to the Syrian army surrounding Samaria and besieging it – preventing passage of food or trade. To briefly demonstrate inflation of price of food, were these two examples of 1) using the head of a 4 leg beast of burden for food (brains, skin, eyes). 2)The dove’s dung (poop) may have undigested seeds which could be picked out and eaten, and as droppings over the city. If the dove landed it would be ensnared and eaten.]

Bible cannibalism See 2 Kings Chapter 6. 28 And the king said unto her, “What aileth thee?” And she answered, “This woman said unto me, Give thy son, that we may eat him today, and we will eat my son to morrow. 29 So we boiled my son, and did eat him: and I said unto her on the next day, Give thy son, that we may eat him: and she hath hid her son.” [Not enough food for 2 for 2 days!]

15) Other means of comparing inflation. I have used stamps as a convenient comparison for purchasing power. Stamps are a global issue by country. They are broadly based, and have a job element, investment, service, and  communications component. What else can be used to study inflation? Postage was thirty three cents (33 cents) when the Notting Hill movie came out (1999). The Antibiotics Saves Lives stamp requires 1 plus another 16 cents to mail a letter in 2018.

communications component. What else can be used to study inflation? Postage was thirty three cents (33 cents) when the Notting Hill movie came out (1999). The Antibiotics Saves Lives stamp requires 1 plus another 16 cents to mail a letter in 2018.

Business students might wonder why not use the Dow Jones Industrial Average (DJIA) which is widely quoted and has been calculating stock prices for more than a century? The DJIA was never intended to compare inflation. It was a simple means to let investors know which direction, up or down was the market. The Dow Jones published the Wall Street Journal, picked 30 of the very biggest companies, added up their stock prices and published the number. Over the years companies have been moved out of the average, some have even gone out of business. So, the stocks in 2018 are not the same as a decade earlier or generations earlier. The only stock company which has lasted since the beginning is General Electric, the other 29 companies have been turned over several times. So the prices of stocks from just a few years are adjusted, but do not represent the same companies. The DJIA past charting is like comparing apples to oranges to walnuts to pickles – their only similarity is two syllables.

Commodity prices are better for comparison. Commodity markets are traded on the Chicago Board of Trade and around the world. Commodities[i] include food – wheat and corn, money, fuel and metals. As wheat is unchanged from year to year, it could be compared in price, and the same can be used to describe other food supplies. However, these are heavily regulated by the government with price support levels, and restrictions on the amount of product. Technology has allowed the American farmer to increase efficiency by six fold while the country has grown several fold. But without interference from the government, food production is dependent on weather or hunger. Commodities can give direction in the inflation of prices, or value of currency.

[i] Ethanol, fertilizer, wheat, corn, oats, soybeans and oil, coffee, cocoa, sugar, stock indices, currencies, crypto currency, interest rates, treasury notes, real estate, crude oil, natural gas, aluminum, iron, gold, silver, copper, platinum, palladium, dollars, Euro, cotton, rice, cattle, hogs, and bonds.

Disclaimer: The author of each article published on this web site owns his or her own words. The opinions, beliefs and viewpoints expressed by the various authors and forum participants on this site do not necessarily reflect the opinions, beliefs and viewpoints of Utah Standard News or official policies of the USN and may actually reflect positions that USN actively opposes. John Choate © No claim in public domain or fair use.

Utah Standard News depends on the support of readers like you.

Good Journalism requires time, expertise, passion and money. We know you appreciate the coverage here. Please help us to continue as an alternative news website by becoming a subscriber or making a donation. To learn more about our subscription options or make a donation, click here.

To Advertise on UtahStandardNews.com, please contact us at: ed@utahstandardnews.com.

Comments - No Responses to “Part four. Inflation Coins and currency?”

Sure is empty down here...